Introduction: Why Open Future World Innovation Matters Now

Digital finance is changing faster than ever. People want better control, more transparency, and safer access to financial services—without complexity.

Open Future World Innovation represents this shift. It focuses on open systems, responsible technology use, and collaboration between banks, fintechs, regulators, and users worldwide.

This article explains the real innovations shaping open finance, what they mean for users, and how the ecosystem is evolving in a practical, trustworthy way.

What Defines Open Future World Innovation?

Open Future World Innovation is not a single platform or product. It is a framework of ideas and technologies built around openness, interoperability, and user control.

Core Principles Behind the Model

- Secure data sharing through consent-based systems

- Interoperability between banks, fintechs, and platforms

- Transparency in financial services

- User-first design and access

The goal is not disruption for its own sake, but better financial outcomes for people and businesses.

Open Banking as the Foundation of Innovation

Open banking remains a key pillar of Open Future World Innovation. It allows customers to share their financial data securely with approved providers.

Why Open Banking Still Matters

- Users can view multiple accounts in one place

- Financial tools become more personalized

- Competition improves service quality

Instead of replacing banks, open banking reshapes how banks operate, encouraging collaboration rather than isolation.

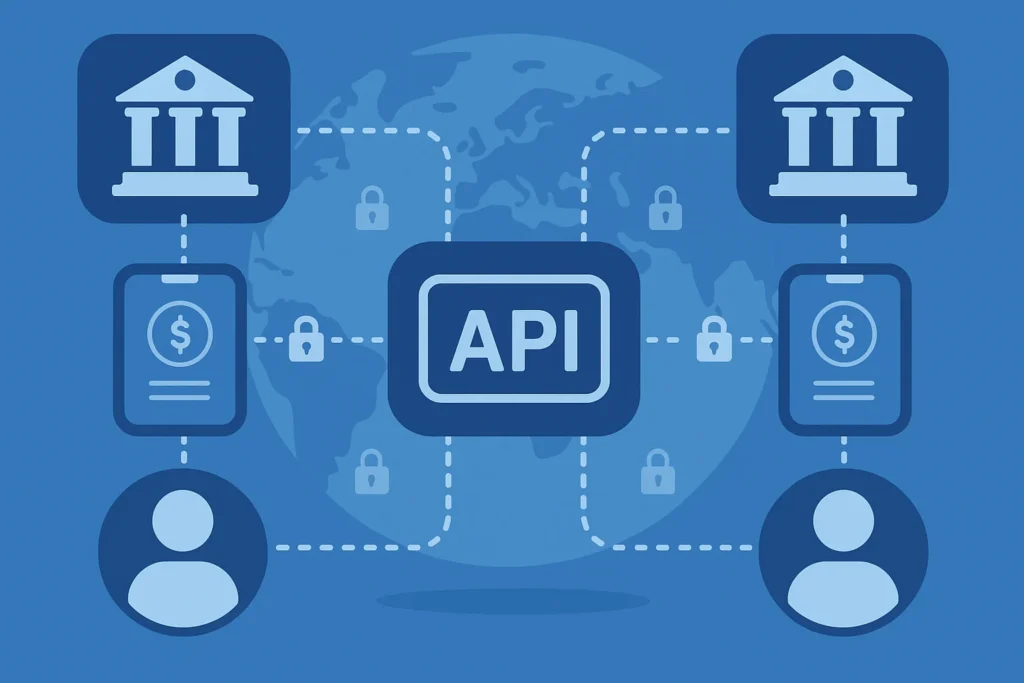

API Ecosystems Powering Modern Finance

APIs are the infrastructure layer behind most open finance systems. They allow applications to communicate securely and in real time.

How APIs Improve User Experience

- Faster account verification

- Seamless payments and transfers

- Integrated budgeting and analytics tools

For businesses, APIs reduce friction and enable scalable innovation without rebuilding core systems.

AI and Data Intelligence in Financial Services

Artificial intelligence is becoming more common across digital finance. Its role is expanding carefully, with increased focus on transparency and fairness.

Practical Uses of AI in Open Finance

- Fraud detection and risk monitoring

- Spending analysis and insights

- Customer support automation

Responsible use of AI helps systems become more efficient without removing human oversight.

Financial Inclusion Through Digital Access

One of the strongest outcomes of Open Future World Innovation is improved access. Mobile-first financial tools are reaching people who were previously excluded.

Inclusion-Focused Innovations

- Mobile wallets and digital onboarding

- Lower-cost remittance solutions

- Flexible micro-finance tools

These solutions work best when paired with clear regulation and digital literacy.

Blockchain and Digital Asset Infrastructure

Blockchain is used selectively within open finance ecosystems. Its value lies in transparency, traceability, and automation—not speculation.

Where Blockchain Adds Value

- Cross-border settlement processes

- Digital identity verification

- Tokenized representations of assets

Adoption remains gradual and use-case driven, focusing on reliability rather than hype.

Cybersecurity and Trust as Core Priorities

As systems become more connected, security becomes non-negotiable. Open Future World Innovation places strong emphasis on trust-by-design.

Common Security Measures

- Multi-factor authentication

- Encryption and secure APIs

- Continuous risk monitoring

Security is no longer reactive. It is built into the system from the start.

Sustainability and Responsible Finance

Technology is increasingly used to support sustainable finance goals. Open systems make reporting and accountability more transparent.

How Technology Supports Sustainability

- Data-driven ESG reporting

- Better visibility into investment impact

- Open access to sustainability metrics

This helps align financial growth with long-term responsibility.

Embedded Finance and Real-Time Payments

Finance is becoming part of everyday digital experiences. Users no longer need separate platforms for basic financial actions.

Examples of Embedded Finance

- Payments within e-commerce platforms

- Insurance offered during checkout

- Instant payouts for gig workers

Real-time payment infrastructure supports faster and more reliable transactions globally.

Regulation and Global Coordination

Innovation depends on trust and legal clarity. Regulators play a growing role in shaping open finance safely.

Regulatory Trends Supporting Innovation

- Open data standards

- Regulatory sandboxes

- Cross-border payment frameworks

Balanced regulation allows experimentation while protecting users.

FAQs About Open Future World Innovation

Is Open Future World Innovation the same everywhere?

No. Adoption varies by region due to regulation, infrastructure, and market maturity.

Does open finance replace traditional banks?

No. It changes how banks operate and collaborate with technology providers.

Is user data safe in open systems?

Security depends on implementation, regulation, and user consent controls.

Is this innovation only for large economies?

No. Many emerging markets benefit significantly from mobile-first solutions.

The Future Outlook: What Comes Next?

Open Future World Innovation is moving toward:

- Greater interoperability

- Stronger security standards

- Clearer user consent controls

The focus is shifting from experimentation to stable, scalable systems.

Conclusion: A Practical Vision for Digital Finance

Open Future World Innovation is about progress without recklessness. It prioritizes openness, trust, and usability over disruption narratives.

As digital finance evolves, systems that respect users, data, and regulation will define the future. That is the real promise of an open financial world—reflected in practical initiatives and solutions offered across our open finance services.