Introduction

The financial world is changing fast, and many people feel confused about what “open banking” and “digital finance” really mean. Users want safer systems, better control over their data, and financial tools that actually help them make decisions.

Open Future World exists to explain, support, and shape this shift. Instead of focusing on hype, it highlights how open banking, APIs, and fintech collaboration are gradually transforming global finance into something more transparent, connected, and user-focused.

This guide explains what Open Future World represents today, how it is evolving toward 2026 and beyond, and why it matters for individuals, businesses, and financial institutions worldwide.

What Is an Open Future World?

A practical vision, not a single technology

Open Future World is not one product or bank. It is a concept and platform-driven approach that supports open banking, digital finance innovation, and responsible data sharing.

Its focus is on:

- Helping people understand open financial systems

- Encouraging collaboration between banks and fintechs

- Promoting secure, regulated use of financial data

Rather than replacing traditional banking, Open Future World emphasizes integration and cooperation across the financial ecosystem.

How Open Banking Powers Open Future World

Giving users more control over their data

At the center of Open Future World is open banking. Open banking allows customers to choose when and how their financial data is shared with trusted providers through regulated APIs.

This enables:

- Easier account aggregation

- Smarter budgeting and financial planning tools

- More transparent comparisons of financial products

Importantly, open banking works within regulatory frameworks. Data sharing happens only with user consent and under defined security standards.

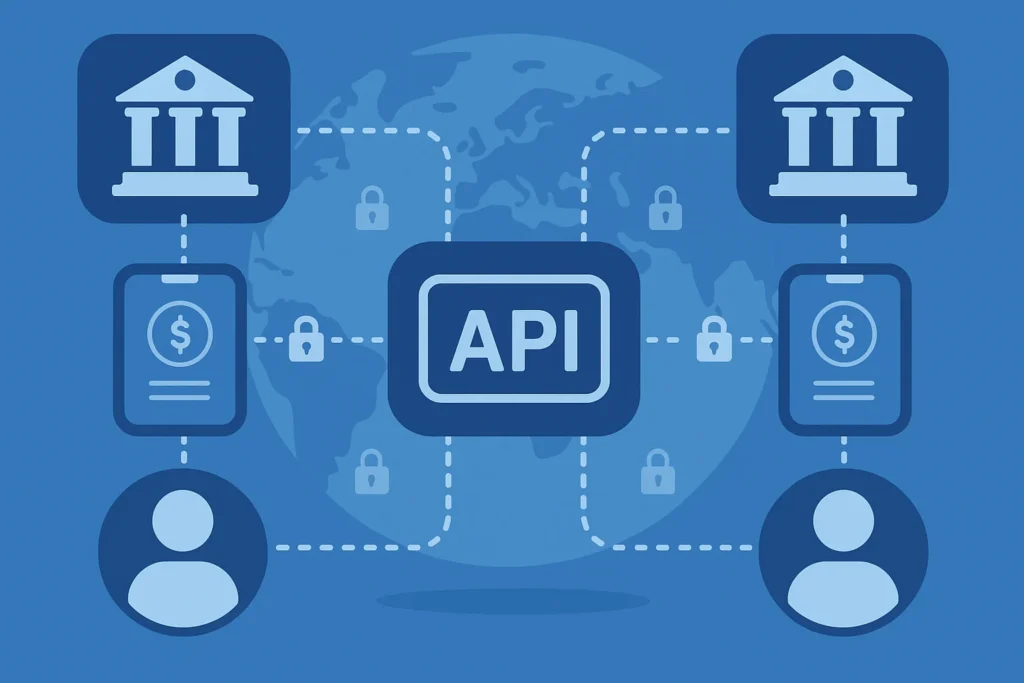

The Role of APIs in the Open Finance Ecosystem

Why APIs matter in modern banking

APIs (Application Programming Interfaces) are the technical backbone of Open Future World. They allow different financial systems to communicate securely and efficiently.

APIs support:

- Real-time account access (with permission)

- Faster and more flexible payment services

- Integration between banks, fintech apps, and platforms

As global finance becomes more connected, standardized APIs help reduce friction while maintaining compliance and security.

Fintech Collaboration, Not Disruption

Moving beyond the “banks vs fintech” narrative

Earlier discussions around fintech often framed it as competition with banks. Open Future World reflects a more realistic shift toward collaboration.

Banks provide:

- Regulatory experience

- Infrastructure and trust

- Risk management expertise

Fintech companies contribute:

- Faster innovation cycles

- User-focused design

- Specialized digital solutions

Together, they build services that are more adaptable and useful for real-world needs.

Security, Privacy, and Trust

Why trust remains the foundation

As data sharing increases, trust becomes more important, not less. Open Future World highlights security as a continuous process rather than a one-time feature.

Key focus areas include:

- Strong customer authentication

- Encrypted data transmission

- Compliance with regional privacy laws (such as GDPR and similar frameworks)

No system is risk-free, but transparent standards and clear consent models help users understand how their data is handled.

Financial Inclusion and Global Access

Expanding access without overpromising

One of the long-term goals associated with Open Future World is improving access to financial services. Digital tools can reduce barriers, especially where traditional banking access is limited.

Possible benefits include:

- Mobile-first financial services

- Easier cross-border payments

- Digital tools for small businesses and freelancers

However, Open Future World also recognizes real challenges, such as internet access, digital literacy, and regional regulatory differences.

Open Future World and Sustainable Finance

Aligning finance with long-term responsibility

As finance becomes more data-driven, sustainability is gaining attention. Open Future World supports the idea that financial systems should reflect environmental and social responsibility where possible.

This may include:

- Better visibility into ESG-related financial data

- Tools that help users understand financial impact

- More transparent reporting standards

Progress varies by region, but awareness is clearly increasing.

Challenges in Building an Open Financial Future

What still needs work

Open Future World does not assume a perfect system. Some ongoing challenges include:

- Differences in global regulations

- Data protection concerns across borders

- Uneven adoption of open banking standards

Addressing these requires cooperation between regulators, institutions, and technology providers rather than quick fixes.

What to Expect Beyond 2026

Gradual evolution, not overnight change

The future of the Open Future World is evolutionary. Instead of dramatic disruption, progress is likely to come through:

- Better API standardization

- Clearer consent and data-use policies

- Improved user education around digital finance

As understanding grows, trust and adoption are expected to follow naturally.

Frequently Asked Questions

Is Open Future World a bank?

No. It represents an open finance approach and knowledge ecosystem, not a financial institution.

Does open banking mean less security?

Not by default. When regulated properly, open banking uses defined security standards and user consent.

Will open finance replace traditional banks?

Unlikely. Most progress points toward integration rather than replacement.

Conclusion

Open Future World reflects a shift in how finance is designed, shared, and understood. It focuses on openness, collaboration, and user choice rather than closed systems and complexity.

By supporting open banking, secure APIs, and responsible fintech innovation, Open Future World helps explain where digital finance is heading — and how people can engage with it more confidently.

The future of finance is not about one platform or technology. It is about clarity, trust, and cooperation, and Open Future World provides a grounded framework for understanding that future.