The open banking future world is transforming how people access, manage, and interact with money. For decades, traditional banks controlled the financial system, offering limited transparency and customer choice. But as technology reshapes finance, open banking has emerged as the foundation for a smarter, more connected financial ecosystem. This evolution marks a shift from closed, institution-driven systems to open, customer-centered innovation — and OpenFuture World is leading that transformation.

The Shift from Traditional to Open Banking

Traditional banking relied on centralized control — customers could only access services offered by their bank. Transactions, data, and financial insights stayed behind closed walls. While secure, this system lacked flexibility and innovation.

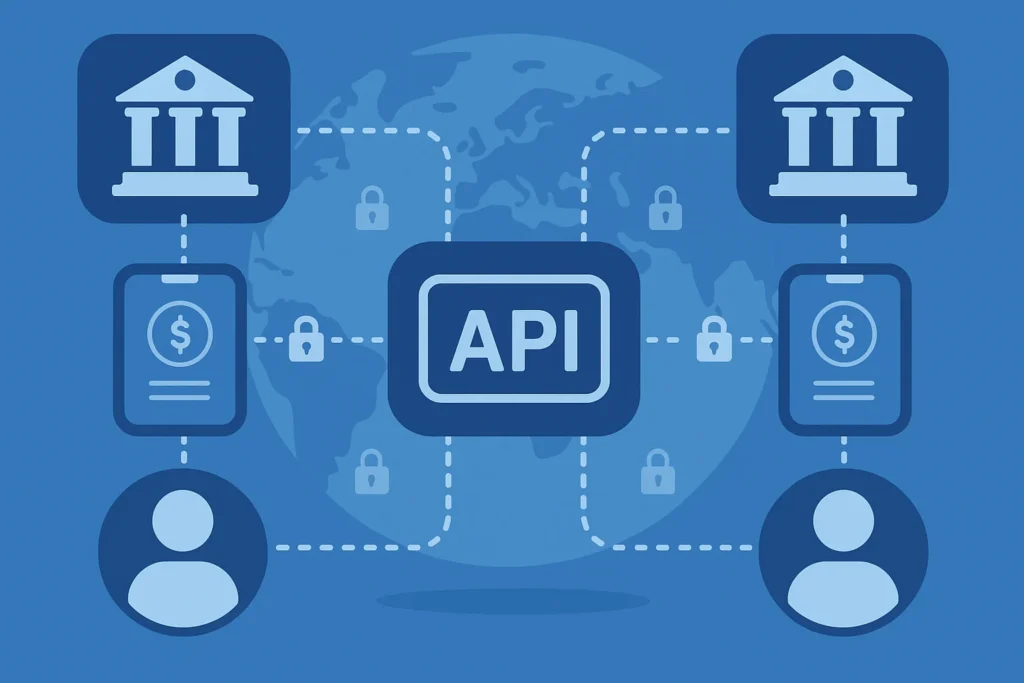

Open banking changes that narrative. It’s built on the principle of data sharing through secure APIs (Application Programming Interfaces), allowing third-party fintechs, payment apps, and digital platforms to connect directly with bank systems. This interconnectedness promotes financial transparency, competition, and user empowerment — the pillars of the open banking future world.

What Is Open Banking?

Open banking allows consumers to securely share their financial data with authorized third parties. By doing so, users gain access to more personalized financial tools — such as smart budgeting apps, automated savings tools, and better loan comparison options.

In the open banking future world, users are no longer bound by one bank’s limitations. They can choose the best financial services available across multiple providers — seamlessly connected within a single digital ecosystem.

Key Components of Open Banking

- APIs (Application Programming Interfaces): The technological bridge between banks and fintechs, enabling secure data exchange.

- Customer Consent: Open banking gives users control. Data sharing happens only when customers permit it.

- Enhanced Security: Open banking systems follow strong regulatory standards, including encryption, multi-factor authentication, and compliance frameworks like PSD2 in Europe.

Traditional Banking: The Old Guard

Before open banking, financial institutions worked in isolation. A customer’s transaction data, credit history, and financial behavior were owned and controlled by one bank. Switching providers or comparing services was slow and difficult.

While traditional banking provided stability and trust, it often failed to meet modern consumer expectations — instant payments, global transfers, mobile access, and integration with apps. This gap paved the way for the open banking future world, which prioritizes connectivity and innovation over confinement.

Open Banking vs Traditional Banking: Key Differences

| Feature | Traditional Banking | Open Banking |

| Data Ownership | Bank owns and controls customer data | Customer owns and shares data securely |

| Innovation Speed | Slow, limited to internal systems | Fast, driven by fintech collaboration |

| User Experience | Basic digital services | Personalized, app-integrated, real-time |

| Transparency | Limited | Full visibility of financial options |

| Security | Centralized protection | Multi-layered, API-driven security |

| Competition | Low – few players | High – fintechs, banks, and digital apps collaborate |

This shift creates a new paradigm: banks are no longer competitors alone but partners in innovation. They collaborate with fintechs to provide a better experience under the open banking future world.

How OpenFuture World Leads the Banking Revolution

OpenFuture World serves as the central hub for global open banking collaboration. It connects banks, fintech innovators, API developers, and regulators to accelerate financial transformation.

By showcasing best practices, real-world API use cases, and digital finance trends, OpenFuture World acts as a bridge between innovation and implementation — helping the world move beyond legacy systems and into an interconnected open banking future world.

Benefits of Open Banking

1. Empowered Customers

Users gain full control over their financial data. Instead of being locked into one institution, they can access personalized solutions tailored to their needs — from low-interest loans to AI-driven budgeting apps.

2. Enhanced Innovation

Open banking encourages fintech startups to create services that complement traditional banking. This collaboration results in smarter payment systems, faster transactions, and innovative financial management tools.

3. Global Financial Inclusion

Millions of unbanked individuals can now participate in the financial ecosystem through open APIs and mobile platforms. The open banking future world ensures that access to financial tools isn’t limited by geography or traditional institutions.

4. Improved Security and Compliance

Contrary to myths, open banking enhances security. By using advanced encryption, tokenization, and regulatory frameworks, it ensures every data exchange is traceable and compliant.

APIs – The Core of the Open Banking Future World

APIs are the silent engine behind open banking. They allow systems to “talk” to each other in real time — enabling everything from seamless payment integrations to multi-bank account dashboards.

In the open banking future world, APIs fuel innovation by turning traditional financial systems into flexible, interoperable platforms that can evolve rapidly with market demands.

For example, instead of manually transferring data between systems, APIs allow instant connection between your bank, credit card, investment platform, and budgeting app — all while maintaining data integrity and security.

The Role of Fintechs and Banks in the Open Banking Future

In this new ecosystem, banks are partners, not gatekeepers. They provide infrastructure, while fintechs deliver user-centric solutions. Together, they form a connected digital finance network that benefits everyone — from individuals to global enterprises.

Fintech Contributions

- Developing smart algorithms for personalized financial recommendations

- Creating seamless payment and lending apps

- Expanding access to credit and global remittance services

Bank Contributions

- Providing secure financial infrastructure

- Ensuring compliance and data integrity

- Partnering with fintechs to scale innovation globally

This collaboration ensures that the open banking future world is not only technologically advanced but also trustworthy and inclusive.

Challenges and the Path Forward

Despite rapid growth, open banking faces several challenges — including consumer awareness, regulatory differences, and cybersecurity concerns. However, the global trend is clear: digital finance is evolving toward openness, collaboration, and user empowerment.

Financial institutions that adapt will thrive in this open banking future world, while those that resist risk being left behind.

The Future Is OpenFuture World

The future of finance is not about competition between banks and fintechs — it’s about collaboration. The open banking future world is redefining financial services with transparency, inclusivity, and customer control at its core.

As APIs, digital platforms, and data-driven insights continue to expand, OpenFuture World stands at the center of this revolution — connecting innovators, empowering customers, and shaping the global future of finance.