Introduction: The New Era of Secure Digital Finance

As the financial world shifts toward openness and technology-driven ecosystems, openfuture.world security has become a cornerstone of digital trust. OpenFuture World represents more than a network of banks and fintechs — it’s a vision of transparent, user-first, and secure financial innovation. But with greater connectivity comes greater responsibility: protecting data, users, and financial integrity is no longer optional — it’s essential.

In this article, we’ll explore how OpenFuture World safeguards digital finance users through robust security frameworks, strong encryption, and transparent governance while redefining what trust means in the open banking era.

The Foundation of openfuture.world Security

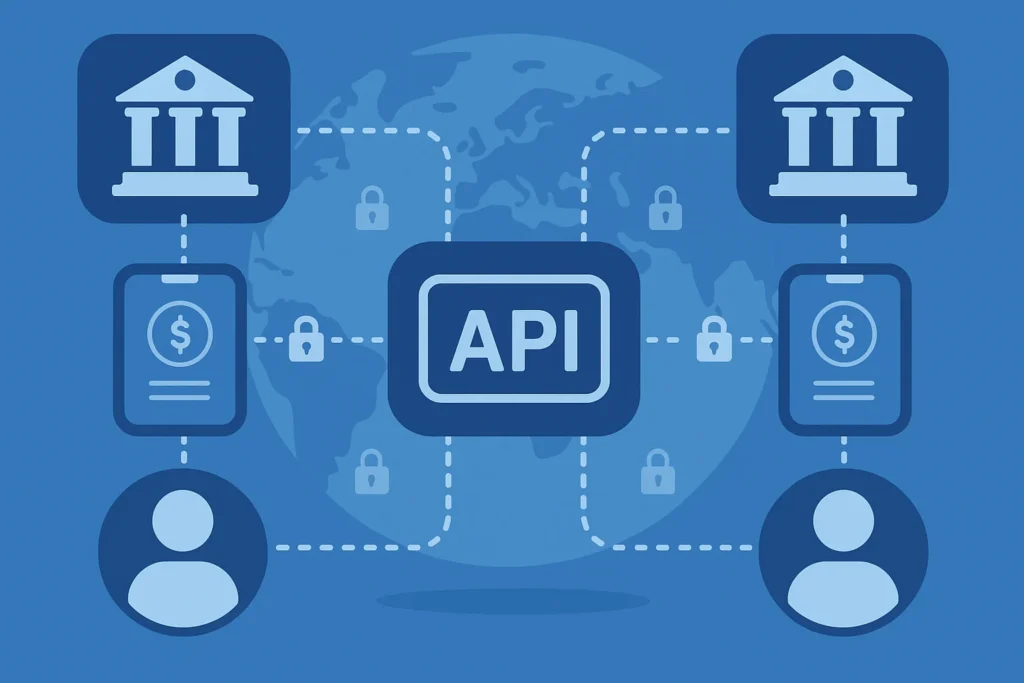

OpenFuture World operates at the intersection of open banking and digital finance, connecting banks, fintechs, and users through APIs. This open structure requires strong security protocols to protect sensitive financial data while enabling seamless innovation.

At the heart of openfuture.world security is an architecture built on three core principles:

- Data Ownership – Users remain the true owners of their financial data, granting access only when they choose.

- Secure APIs – Advanced authentication and encryption ensure that data travels safely across all endpoints.

- Transparency and Compliance – Every transaction and data request is monitored and logged to meet regulatory standards such as PSD2, GDPR, and ISO/IEC 27001.

This foundation ensures that innovation doesn’t compromise safety — it enhances it.

Why Security Matters in Open Banking

The transition from traditional banking to open finance exposes both opportunities and risks. Traditional systems were closed, with limited data sharing. OpenFuture World introduces a new ecosystem where multiple players — banks, fintech startups, and users — interact via APIs.

However, without advanced openfuture.world security protocols, this openness could become a vulnerability. That’s why OpenFuture World emphasizes:

- Two-Factor Authentication (2FA): Adds a second layer of verification for users.

- End-to-End Encryption: Ensures no unauthorized access during data exchange.

- Secure API Gateways: Filter and verify requests to prevent fraud or malicious activity.

Security isn’t just technical — it’s about trust. Users share their data because they believe in the platform’s integrity, transparency, and accountability.

The Role of AI and Machine Learning in Security

The OpenFuture ecosystem uses AI-driven security intelligence to detect and prevent potential threats in real time. Machine learning models analyze user behavior, transaction patterns, and access requests to identify anomalies before they cause harm.

Key innovations include:

- Behavioral Biometrics: Recognizes unique user interaction patterns to detect suspicious behavior.

- Predictive Threat Analysis: Anticipates cyberattacks before they occur.

- Adaptive Authentication: Adjusts security levels based on risk factors — like device type or login location.

Through continuous learning, OpenFuture World strengthens its defense mechanisms and maintains the highest trust standards in digital finance.

Building Trust through Transparency

Trust in the digital era isn’t built overnight — it’s earned through openness, consistency, and ethical management of data. OpenFuture World follows a “Transparency by Design” approach, ensuring that users understand where their data is stored, how it’s used, and who accesses it.

Transparency is achieved by:

- Providing real-time audit trails for all transactions.

- Offering clear consent management tools for data sharing.

- Conducting independent security audits to maintain global compliance.

These measures ensure that users always stay in control of their financial data — a fundamental principle of openfuture.world security.

Protecting Fintech Collaboration with API Security

The backbone of the OpenFuture ecosystem is its API-driven architecture, connecting banks, payment processors, and fintech platforms. However, APIs are also prime targets for cyberattacks.

To mitigate these risks, OpenFuture World employs:

- OAuth 2.0 and OpenID Connect protocols for secure authorization.

- API throttling and rate limiting to prevent denial-of-service attacks.

- Regular vulnerability testing to identify and patch risks early.

By enforcing these standards, OpenFuture World ensures that innovation and security coexist — enabling fintechs to build confidently within a trusted environment.

Compliance and Global Regulatory Alignment

Security in open banking must align with international laws and regional regulations. OpenFuture World integrates compliance frameworks such as:

- GDPR (General Data Protection Regulation) for European data privacy.

- PSD2 (Payment Services Directive 2) to ensure safe financial transactions.

- ISO/IEC 27001 for standardized information security management.

By embedding compliance within every layer of its infrastructure, OpenFuture World not only meets regulatory demands but also sets new industry benchmarks for trust and reliability.

Educating Users: Security Awareness Matters

Even the most secure systems can be compromised if users aren’t aware of best practices. OpenFuture World invests in financial literacy and security awareness programs, helping users understand:

- How to recognize phishing or scam attempts.

- Why strong passwords and multi-factor authentication are essential.

- The importance of regularly reviewing connected apps and permissions.

Empowered users are the strongest defense in the digital finance ecosystem.

The Future of openfuture.world Security

As fintech innovation accelerates, the threats facing digital finance will evolve. OpenFuture World is already preparing for the next generation of security — incorporating quantum-safe encryption, decentralized identity systems, and biometric blockchain verification to stay ahead of future challenges.

The platform’s mission is clear: to build a secure, inclusive, and transparent financial future where users can trust every transaction, every time.

Conclusion: Trust Is the Currency of the OpenFuture World

In the age of open banking, trust defines success. Openfuture.world security ensures that every innovation, partnership, and financial interaction operates within a framework of integrity and protection.

By combining cutting-edge technology with transparent governance, OpenFuture World sets a new global standard for secure digital finance. The future is open — but above all, it’s safe.