In today’s fast-evolving digital finance landscape, openfuture.world stands out as a global leader driving financial inclusion and transparency. The platform isn’t just redefining how people interact with money — it’s creating a world where everyone, regardless of background or location, can access fair and secure financial services.

Through open banking, fintech innovation, and powerful API integrations, OpenFuture World empowers communities, banks, and startups to collaborate for a more inclusive financial ecosystem.

The Mission Behind openfuture.world

The mission of openfuture.world is simple yet transformative — to make finance more accessible, connected, and innovative.

Traditional banking models often excluded millions due to limited access, high fees, or lack of infrastructure. By leveraging open banking principles, OpenFuture World bridges these gaps, providing individuals and businesses with tools to thrive in a modern, connected economy.

The platform brings together financial institutions, fintech companies, and technology innovators to create a global hub for digital finance transformation. Its secure data-sharing framework enables more personalized, transparent, and efficient financial products — empowering both consumers and developers alike.

How Open Banking Drives Inclusion Through OpenFuture World

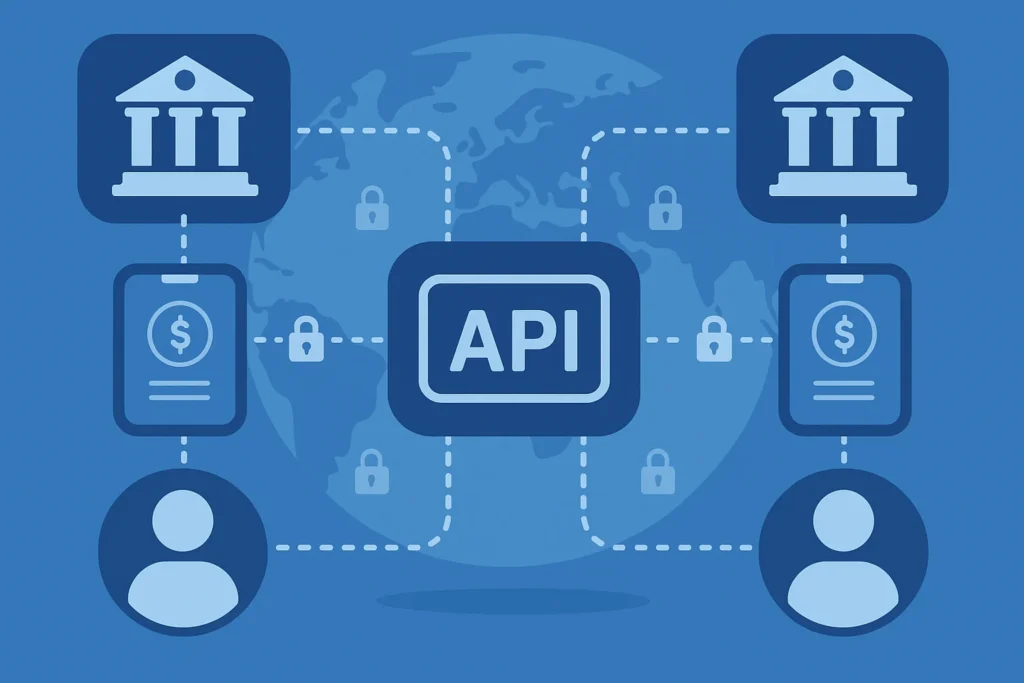

At the heart of openfuture.world lies open banking — a concept that allows banks and fintech platforms to share data securely through APIs. This empowers users to control their financial data while enabling third-party providers to design better, more personalized services.

With OpenFuture World’s approach, underserved populations gain access to credit, digital payments, and financial literacy tools. In many emerging markets, people without traditional bank accounts can now connect to fintech apps offering affordable solutions — from mobile savings to microloans.

API Innovation and Financial Empowerment

The use of APIs (Application Programming Interfaces) is central to OpenFuture World’s vision. APIs enable seamless communication between financial systems, helping institutions innovate faster and reach broader audiences.

Through its open ecosystem, openfuture.world supports startups and developers in building smarter applications that integrate global finance securely and efficiently. By offering API-driven access to banking data, the platform helps businesses create better customer experiences and promotes financial literacy.

The result? A world where technology connects individuals to opportunities previously out of reach.

Security and Trust at the Core of OpenFuture World

As financial data becomes increasingly digital, security remains a top priority. Openfuture.world ensures that its framework follows international data protection and compliance standards — strengthening trust between consumers, banks, and fintech developers.

Every transaction and API connection within OpenFuture World is encrypted and regulated, ensuring a compliant and secure ecosystem. This enhances consumer confidence and attracts large institutions seeking a trusted environment for digital collaboration.

Building Confidence Through Transparency

Transparency is another cornerstone of OpenFuture World. By clearly explaining how data is accessed and shared, the platform promotes accountability and user trust. Consumers retain control over their information, while institutions gain reliable insights to improve services and reduce risks.

This transparency fuels a sustainable ecosystem where innovation and inclusion coexist — ensuring that the future of banking is both open and ethical.

Fintech Innovation and Global Collaboration

Openfuture.world is more than a platform — it’s a global movement connecting innovators across fintech, banking, and digital finance. Through partnerships and knowledge-sharing, it creates an environment where collaboration replaces competition.

Financial inclusion isn’t just about technology; it’s about connecting people to opportunities. OpenFuture World encourages partnerships that tackle real-world challenges such as digital identity, credit accessibility, and cross-border payments.

The Role of Fintech Startups in Financial Inclusion

Startups are the backbone of this transformation. By leveraging OpenFuture World’s ecosystem, fintech startups gain access to vital resources, research, and connections that enable responsible innovation.

They can scale globally while maintaining compliance — a key advantage in today’s regulatory landscape. With the support of openfuture.world, startups are designing digital wallets, payment gateways, and credit solutions that empower unbanked and underbanked populations worldwide.

openfuture.world and the Future of Global Banking

The future of banking is open, data-driven, and user-centric — and openfuture.world is leading this evolution. By aligning innovation with inclusion, the platform is redefining how financial systems operate across borders.

Its ongoing investment in API infrastructure, cybersecurity, and fintech partnerships ensures that financial growth remains both sustainable and equitable. Traditional banks, neobanks, and technology firms can all coexist and innovate within this shared ecosystem.

A Digital Ecosystem Without Boundaries

In a connected world, financial inclusion requires breaking down geographical and institutional barriers. OpenFuture World enables this by linking users to a digital finance ecosystem that transcends borders.

From cross-border payments to digital currencies and fintech tools, the platform is reshaping what it means to be financially connected in the 21st century.

Empowering People Through Knowledge and Access

Financial inclusion is not just about access — it’s about empowerment through understanding. OpenFuture World offers educational resources and community insights that help users navigate digital finance confidently.

By promoting financial literacy and awareness, openfuture.world ensures that every participant — whether a consumer, developer, or institution — benefits from open banking responsibly.

This educational foundation helps communities embrace financial transformation with trust and confidence.

Conclusion – A Connected Future Through openfuture.world

The journey toward global financial inclusion is far from over, but openfuture.world is paving the path forward. Its commitment to open banking, fintech collaboration, and secure innovation continues to redefine what’s possible in digital finance.

By empowering individuals and institutions to participate in a transparent and inclusive economy, OpenFuture World stands as a symbol of progress.

In this new digital era, financial freedom is no longer a privilege — it’s a shared global reality.