Introduction

The financial landscape is changing faster than ever before, driven by technology, innovation, and evolving customer expectations. In this new era, banking OpenFuture World stands as a symbol of progress — redefining how individuals, businesses, and institutions interact with money. OpenFuture World embraces the digital transformation in banking by integrating open banking, fintech innovation, and API-driven ecosystems that make financial services faster, more secure, and more accessible to everyone.

This article explores how OpenFuture World is shaping the future of banking through a modern, connected, and transparent approach to digital finance.

Understanding Digital Transformation in Banking

Digital transformation in banking goes beyond adopting technology — it’s about changing the entire mindset of how banking operates. The focus has shifted from traditional, closed systems to open, collaborative networks where data and innovation flow seamlessly between banks, fintechs, and consumers.

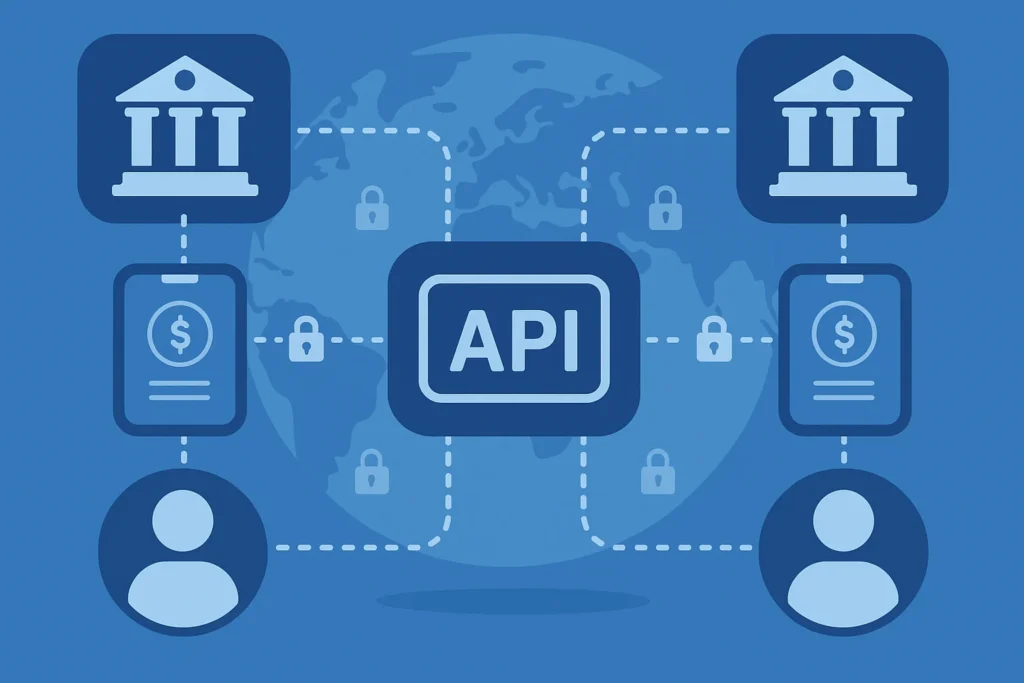

At the heart of this transformation lies open banking, a key pillar that allows third-party applications to securely access financial data through APIs. With this foundation, banking OpenFuture World promotes inclusivity, transparency, and real-time financial decision-making.

Key Drivers of Digital Banking Transformation

- Customer-Centric Innovation: Today’s customers expect seamless, digital-first banking experiences. OpenFuture World supports this demand by enabling personalized financial services powered by artificial intelligence and data insights.

- API Integration: APIs (Application Programming Interfaces) are the backbone of open banking. They allow financial institutions to securely share information and services across different platforms, promoting interoperability and innovation.

- Fintech Collaboration: Instead of competing, banks and fintechs now collaborate. This synergy, championed by OpenFuture World, helps deliver faster, smarter, and more efficient financial solutions to end users.

The OpenFuture World Framework

1. Open Banking as the Foundation

The banking OpenFuture World approach begins with open banking — a framework where banks share customer data (with consent) through secure APIs. This model empowers consumers to use third-party apps for budgeting, payments, lending, or investments, all while maintaining control over their financial data.

Through this open system, OpenFuture World enhances transparency and encourages healthy competition among service providers. This results in better financial products, lower costs, and improved customer experiences.

2. Building Trust Through Security and Compliance

In an era of data sharing, security is non-negotiable. OpenFuture World ensures that every transaction and data exchange follows strict regulatory frameworks like PSD2 (in Europe) and similar standards globally. Encryption, multi-factor authentication, and secure API gateways are implemented to protect user data at every stage.

This focus on trust and security helps users feel confident about participating in open banking ecosystems — a critical step toward mass adoption of digital finance.

3. Promoting Financial Inclusion

OpenFuture World’s mission is not just innovation but inclusion. Millions of people worldwide remain unbanked or underbanked. By leveraging APIs and digital solutions, OpenFuture World enables access to essential financial services — even in regions with limited traditional banking infrastructure.

Through mobile-based solutions and cross-border digital platforms, individuals can open accounts, make payments, or apply for loans without needing to visit a bank physically.

Banking Reinvented: How OpenFuture World Leads the Way

API-Powered Banking Ecosystem

OpenFuture World thrives on an API-driven structure that allows different players — from banks to fintech startups — to collaborate seamlessly. APIs simplify integrations between services such as digital wallets, investment platforms, and payment gateways, leading to faster innovation and better customer experiences.

For example, a user might connect their bank account to a budgeting app or investment tool in seconds — a direct outcome of API interoperability under the banking OpenFuture World model.

Real-Time Data and Personalization

Data is the new currency of digital banking. By using AI and machine learning, OpenFuture World helps banks analyze financial behavior, detect fraud, and offer personalized recommendations. This creates a proactive, rather than reactive, banking experience.

Imagine receiving instant loan offers tailored to your spending patterns or investment advice aligned with your goals — that’s the personalized future OpenFuture World is building.

Cloud and Blockchain Integration

To ensure scalability and security, OpenFuture World embraces cloud computing and blockchain technologies. Cloud infrastructure allows for efficient data management and faster service delivery, while blockchain enhances transparency and reduces fraud risks in digital transactions.

These technologies collectively ensure that the open banking ecosystem remains stable, secure, and ready for global expansion.

The Role of Fintechs in the OpenFuture World Ecosystem

Fintech companies are catalysts in the evolution of digital banking. OpenFuture World encourages these innovators to collaborate with traditional banks, merging trust with agility. Fintechs bring creativity, while banks offer scale and compliance — together, they deliver modern financial solutions to users worldwide.

From peer-to-peer lending platforms to automated investment services, fintech partnerships under banking OpenFuture World are redefining what it means to manage money in the digital age.

Challenges and Future Opportunities

While digital transformation offers countless benefits, challenges remain — from data privacy to interoperability issues. OpenFuture World tackles these hurdles by promoting standardized APIs, regulatory alignment, and user education.

Future Opportunities Ahead

- Global Standardization – Developing unified global open banking frameworks for smoother international transactions.

- AI-Driven Financial Insights – Delivering predictive insights and automated financial planning.

- Cross-Border Collaboration – Enabling secure and instant payments between different countries and currencies.

- Green Finance and ESG Integration – Supporting sustainability by integrating eco-friendly finance initiatives into digital platforms.

The Future of Banking: Connected, Open, and Inclusive

The vision of banking OpenFuture World is clear — a future where finance is borderless, data-driven, and customer-empowered. By combining technology, security, and human-centric innovation, OpenFuture World is leading the charge toward a smarter, fairer, and more accessible global financial system.

As banks evolve from closed institutions into open, collaborative ecosystems, OpenFuture World ensures that no one is left behind. Digital transformation isn’t just about modernization — it’s about shaping a financial future that truly works for everyone.

Conclusion

The digital transformation in banking marks the dawn of a new financial era — one where innovation, transparency, and inclusion come together under one roof. Banking OpenFuture World represents this shift, connecting banks, fintechs, and consumers in a secure, data-driven environment.

By embracing open banking, advanced APIs, and fintech partnerships, OpenFuture World is redefining how the world experiences finance. The future of banking is open — and OpenFuture World is paving the way.