Introduction

OpenFuture World is focused on explaining and supporting how modern digital finance works in an open, connected environment. As financial systems evolve worldwide, users and businesses need clear, trustworthy information about open banking, data sharing, and digital tools.

This guide explains OpenFuture World in simple terms—what it is, how it works, and why it matters for everyday users, fintech teams, and financial institutions across different regions.

What Is the OpenFuture World?

OpenFuture World is a global digital finance platform and knowledge hub centered on open banking, APIs, and financial technology innovation.

Its goal is to help people understand how financial data can be shared securely and responsibly to create better services—without requiring deep technical knowledge.

How OpenFuture World Approaches Digital Finance

Moving Beyond Closed Banking Systems

Traditional banking systems often operate in isolation. OpenFuture World highlights a different approach—one where banks, fintech companies, and users interact through secure digital connections.

This approach supports:

- Greater transparency

- More user choice

- Improved service innovation

Rather than replacing banks, open systems aim to improve how financial services are delivered.

Open Banking Explained Simply

Open banking allows individuals and businesses to share their financial data with approved third-party services, using secure permissions.

How OpenFuture World Supports This Concept

- Explains open banking standards in plain language

- Focuses on consent-based data sharing

- Highlights real-world use cases instead of theory

Examples may include budgeting apps, credit assessment tools, or payment services—depending on local regulations.

Why APIs Matter in OpenFuture World

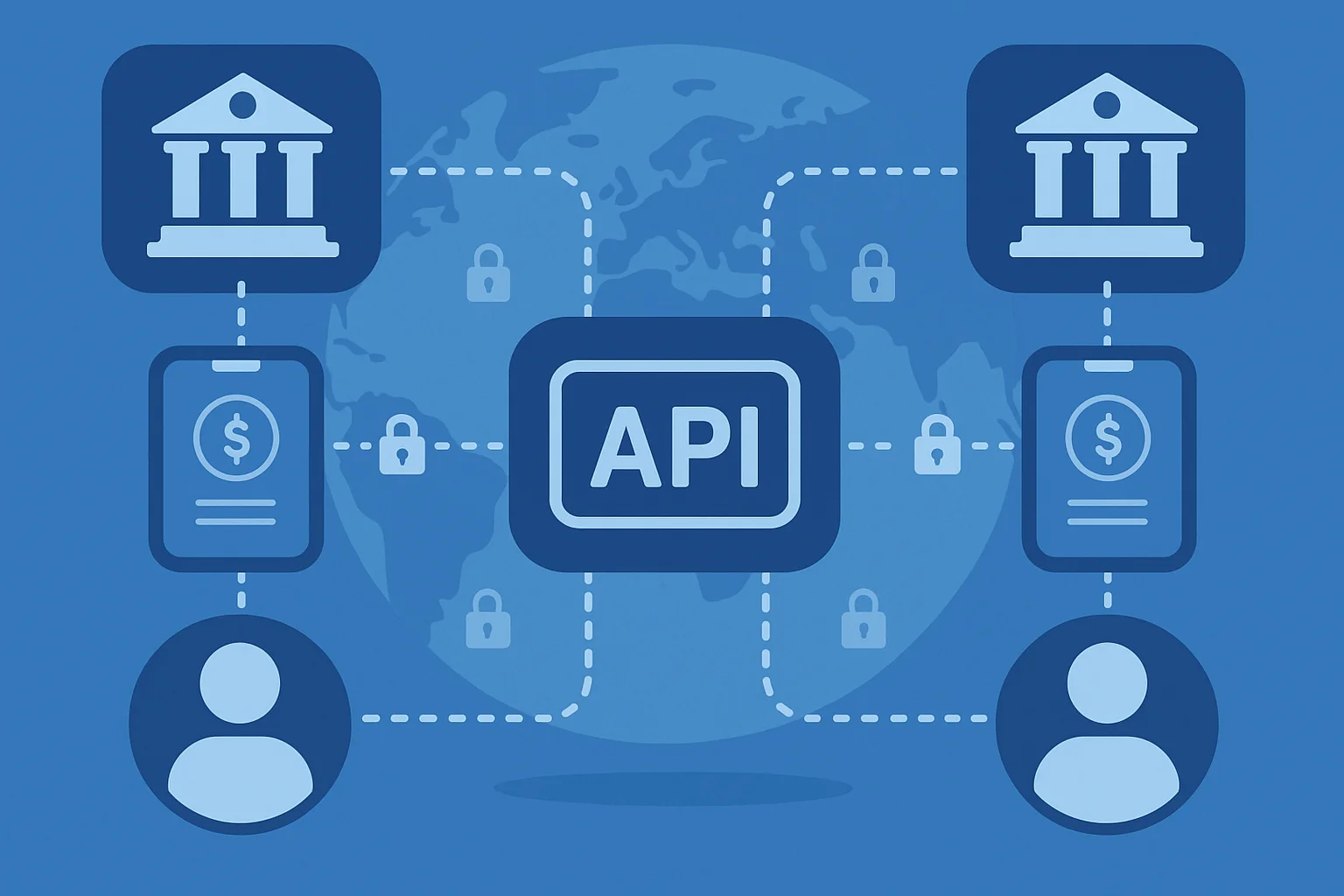

APIs as Digital Connectors

APIs (Application Programming Interfaces) allow different financial systems to communicate safely.

Within the OpenFuture World ecosystem, APIs help:

- Verify account information securely

- Enable faster digital payments

- Support personalized financial tools

- Reduce friction between platforms

APIs are not user-visible, but they power many modern financial experiences.

Financial Inclusion and Accessibility

Access to financial services varies greatly by country and region. OpenFuture World focuses on education and awareness around tools that may help improve inclusion.

Potential use cases include:

- Mobile-based payment solutions

- Digital wallets

- Low-cost transfer systems

- Small business payment tools

Actual availability depends on local infrastructure and regulation, which OpenFuture World encourages users to understand.

Security, Privacy, and User Control

How Trust Is Addressed

OpenFuture World emphasizes widely accepted digital finance principles rather than guarantees.

These include:

- User consent before data sharing

- Encrypted data transmission

- Regulatory alignment where applicable

- Clear explanations of data rights

Security practices vary by provider, but transparency remains central.

Open Finance: The Next Evolution

Open banking is often a starting point. OpenFuture World also explores open finance, which may include:

- Investment data

- Insurance services

- Pension information

- Cross-platform financial insights

Adoption levels differ globally, but the trend toward broader data access is growing.

Fintech Innovation and Collaboration

Fintech companies play a major role in shaping digital finance. OpenFuture World highlights how open systems can support:

- Faster experimentation

- Lower technical barriers

- Improved customer experience

- Cross-industry collaboration

This collaboration can benefit both startups and established institutions when implemented responsibly.

Frequently Asked Questions (FAQs)

Is OpenFuture World a bank?

No. It is not a bank or financial institution. It focuses on education, insights, and digital finance concepts.

Does open banking mean my data is public?

No. Open banking relies on user permission. Data is shared only with approved providers and only when consent is given.

Is open banking available worldwide?

Availability depends on country-specific laws and regulations. OpenFuture World addresses this from a global perspective.

Who benefits most from open finance?

Consumers, small businesses, developers, and financial service providers may all benefit, depending on use cases.

Conclusion

OpenFuture World provides a clear, balanced view of how open banking and digital finance work in today’s interconnected economy. By focusing on education, transparency, and responsible innovation, it helps users and businesses navigate financial change with confidence.

As financial systems continue to evolve, platforms like OpenFuture World play an important role in making complex topics understandable—without hype, risk, or misinformation.